The Bilanz is one of the most critical financial statements for any business owner to understand. It keeps lenders, creditors and potential investors

The Bilanz is one of the most critical financial statements for any business owner to understand. It keeps lenders, creditors and potential investors informed about a company’s status at any given time.

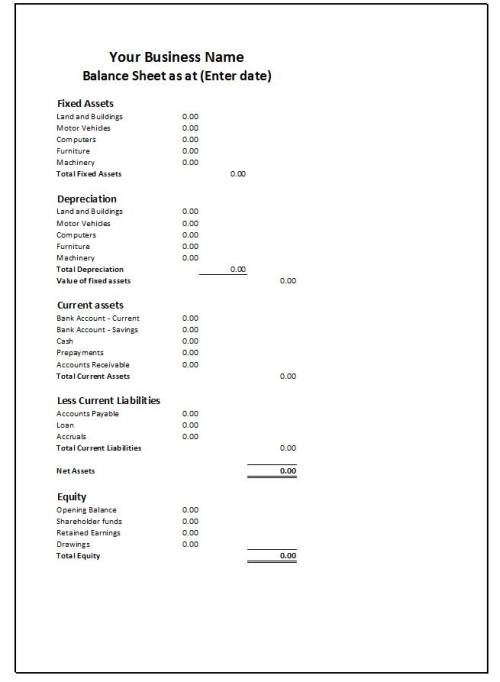

Assets, liabilities and shareholders’ equity are listed on the balance sheet. These items should equal each other to balance out a company’s finances.

Assets

Assets on a balance sheet are the things a company owns or controls that generate economic value, like buildings, machinery, equipment and trademarks. They can also be intangible assets, such as trade secrets, industry know-how and patents.

The most liquid type of asset, cash, appears first on a balance sheet. Companies lump this line item together with cash equivalents, which include short-term investments and marketable securities that have short maturities or can be sold quickly.

This means they can be converted into cash on short notice, and a business can use this money to cover its current needs or pay off its debts.

Long-term assets are the resources that are expected to continue delivering value over time, such as buildings and equipment. They’re listed at their cost, and depreciation is reported over the asset’s estimated life. Other assets may be categorized as noncurrent or fixed, based on whether they’re necessary for the business’s operations and how long they’ll last.

Liabilities

A balance sheet includes everything your business owns with value, plus any debt it owes. This includes money owed to other businesses, lenders, investors and creditors.

Assets on a balance sheet include cash and cash equivalents, prepaid expenses, accounts receivable, real estate, inventory, investments and intangible assets. They’re listed in descending order, with current and long-term assets at the top, followed by those that can be converted into cash within a year.

Liabilities on a balance sheet include debts, including short-term loans and business mortgages. They are also grouped into two categories: current liabilities, which are due within one year, and noncurrent liabilities, which are due more than a year in the future.

Examples of current liabilities on a balance sheet include client deposits, accounts payable, salaries and wages payable and any amount owed to suppliers. Deferred revenues, which is a company’s cash received from customers for goods or services that will be delivered in the future, also counts as a liability on a balance sheet.

Shareholders’ Equity

Stockholders’ equity (SE) is the difference between a company’s assets and liabilities. It’s a valuable data point that allows analysts and investors to see how well the business is doing.

The SE section of a balance sheet is comprised of four categories: stock (common, preferred, and treasury), unrealized gains or losses, additional paid-in capital, and retained earnings. All of these components provide useful information to help investors understand how well a company is doing.

The shareholder’s equity on a balance sheet is usually positive, meaning that the company has more assets than it has liabilities. However, it can also be negative if the company has more liabilities than assets. Having a negative SE is a sign that the company may be in trouble.

Cash

A balance sheet shows the assets and liabilities of a company at a certain point in time. Assets include money, property, inventory and equipment. Liabilities include payroll expenses, debt payments, money owed to suppliers and taxes.

A company’s cash balance is shown in the current assets section of its balance sheet. It includes cash and cash equivalents, such as savings bonds, certificates of deposit, and money market funds.

According to the BBC, cash levels on a balance sheet can indicate the health of a company. A growing balance over time can indicate higher sales and productivity, while a low balance may warn of insolvency.

In addition to cash, a company’s balance sheet may also include investments in short-term securities that could be sold quickly or converted into cash. These assets are called cash equivalents because they are highly liquid and readily convertible into cash.

COMMENTS